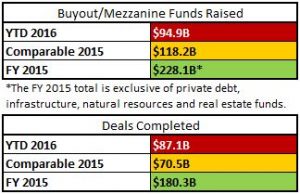

U.S.-based buyout and mezzanine fundraising padded its total by about $6 billion over the past two weeks, bringing the yearly aggregate to $94.9 billion. The total, however, still sits nearly $23 billion — around 20 percent — below this time in 2015.

Arbor Investments closed a pair of funds for a combined $875 million. Arbor Investments IV soared 25 percent above the $600 million target, closing on $750 million. Its first mezzanine vehicle, Arbor Debt Opportunities Fund I, wrapped up with $125 million.

Monomoy Capital Partners hit $767 million for its third primary turnaround fund while aiming for $650 million.

General Atlantic continues to stockpile commitments for two of its pools. General Atlantic Partners 93 has now amassed $2.3 billion and compiled $1.9 billion for General Atlantic Partners III.

A pair of shops launched their maiden vessels onto the private equity waters. H&F Polaris Partners released its self-titled debut and has thus far collected $300 million. MedMen, a firm focused on harvesting the legal marijuana industry, is seeking $100 million for MedMen Opportunity Fund.

Dealmaking was tepid, adding only $2.7 billion to its year-to-date sum of $87.1 billion.

An investor group of Ivanhoe Cambridge and Callahan Capital Properties acquired the entirety of Manhattan’s 1211 Avenue of the Americas office building from Beacon Capital Partners for $913 million.

Cision US Inc, owned by GTCR, bought out PR Newswire Association LLC, a provider of online news and information distribution services, from United Business Media PLC. The deal was valued at $841 million.

Blackstone Group purchased three retail real estate portfolios of Melbourne, Australia-based Vicinity Centres in a leveraged buyout for $450.9 million.

Additional Data

Ratings Wrap-Up (June 17, 2016 – June 30, 2016)

IPO REGISTRATIONS BY SELECT PRIVATE EQUITY H-BACKED COMPANIES IN 2015-2016 YTD

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: